Cannabis beverages: patience is the word

USA | Long time no hear from cannabis beverages. Although much hyped in 2019, they seem to have disappeared from view as hard seltzers have taken off. But don’t write them off yet.

According to a recent report by the Beverage Marketing Corporation (BMC), a data firm, cannabis is a rare case of a market which is ambiguous as to its legality, even as it continues to remove its legal ambiguity.

Cannabis consists of two main components: tetrahydrocannabinol (THC) and cannabidiol (CBD). THC is the chemical compound that is responsible for its intoxicating effects. CBD is one of the more than 100 cannabinoids (diverse chemical compounds that act on cannabinoid receptors) found in the cannabis plant.

As says the BMC, “The Farm Bill, passed in 2018, made industrial hemp legal. Subsequently, the Department of Agriculture declared industrial hemp legal. However, the Food and Drug Administration (FDA) has provided no guidance other than declaring illegal any products that are explicitly marketed as CBD or make benefit claims. This has driven many hemp marketers to remove CBD from labels and call their products full-spectrum hemp and indicate on the labels that the product contains cannabinoids.”

FDA keeps shtoom

Per the BMC, “the market for beverages labelled as containing CBD is currently in limbo as the federal government has yet to issue final guidelines on whether CBD is permissible in food and drink, and, if so, at what dosages.”

A recent report by the all-powerful FDA dampened hopes of an expedient decision, claiming that about half of the products it tested contained more than 0.3 percent THC by dry weight (but are not identified as containing THC on the labels)and that a majority of the products it tested contained either 20 percent less or 20 percent more CBD than what is stated on the labels.

Allegedly, CBD has anti-inflammatory and anxiolytic properties and can help relieve pain and insomnia. Therefore, the future success of CBD products will hinge on whether consumers deem them efficacious for these purposes, the BMC report says.

It is expected that marketers will differentiate their products by including other cannabinoids such as cannabigerol (CBG) and cannabinol (CBN).

The fact that THC is already widely consumed illicitly is one of the reasons analysts are optimistic about its prospects. The other reason, of course, is its uptake in states where recreational and/or medical marijuana is already allowed.

Federal legislation postponed

It seems that THC and CBD products face two different challenges: legality (in the case of THC) and efficacy (CBD).

The factor that will provide rocket fuel to the THC market is federal legalisation, which was expected to occur in 2021 but may be pushed off to 2022, according to BMC.

Although the legal and regulatory uncertainty has blunted the trajectory of cannabis-infused beverages, the segment has still grown rapidly, albeit from a small base. Cannabis drinks had more new product introductions than any other non-alcoholic, ready-to-drink beverage category in the first quarter of 2020, with no signs of abatement.

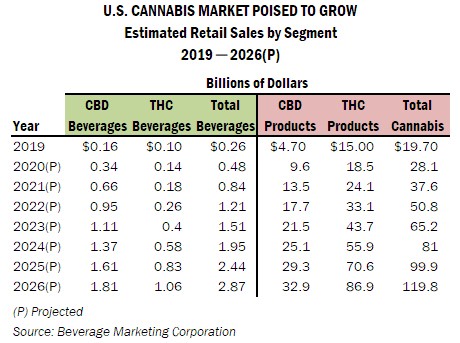

While it is standard procedure to hedge one’s bets about future outcomes, this is doubly the case with the cannabis market. As it currently stands, BMC projects that THC will dominate the cannabis market overall by 2026, but that CBD-infused beverages (including full spectrum hemp) will be larger than THC-infused beverages in six years’ time.

Nevertheless, cannabis products are expected to vastly outperform cannabis beverages.