Southeast Asian beer market expected to grow in mid-single digits

Vietnam | Euromonitor says that the beer scene in Southeast Asia is booming. Beer consumption is expected to grow 5 percent annually up to 2023 from 90 million hl in 2017, with the Philippines and Vietnam being the key drivers for growth.

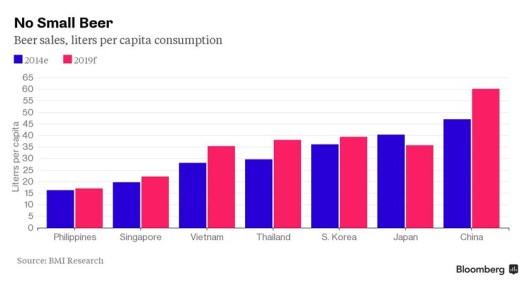

As China and Japan have seen beer volumes decline, the Asian subregion, including Myanmar, Thailand, Cambodia, Laos, Vietnam, Malaysia, the Philippines and Indonesia, has emerged as the next frontier for global brewers.

Tight alcohol regulations and government interferences notwithstanding, the old adage that beer consumption can only go up if there is population growth and rising GDP in the context of political stability, also applies to this region. Southeast Asia’s population alone is expected to increase from 660 million to 700 million people by 2025.

Vietnam’s beer market beckons

Key among Southeast Asian markets is Vietnam. The country has seen beer volumes climb by an average of 6.6 percent for the past six years to 43 million hl in 2018, compared with an increase of just 0.2 percent for beer consumption globally. That growth, plus its population of nearly 100 million, and beer’s 95 percent share of alcohol consumption, make it an alluring market, according to Euromonitor.

Hence Thai Beverage (ThaiBev) acquired a majority stake in the leading brewer Sabeco (40 percent market share in 2018), while Heineken, which is ranked second with a market share of 31 percent, has expanded its production capacity to cater to strong domestic demand. Carlsberg’s years-long efforts to increase its stake in brewer Habeco underline the market’s potential.

Euromonitor forecasts that Vietnam will overtake Japan (51 million hl beer in 2018) in beer volume terms by 2023.

The Philippines paint a similar picture. Following San Miguel (90 percent market share) and Heineken’s improved distribution reach, Euromonitor is certain that the beer market will continue to expand from the 22 million hl beer produced in 2018.

Thailand’s beer consumption is subdued

The only country to spoil Euromonitor’s overall optimistic forecasts is Thailand, where beer consumption (estimated at 18 million hl in 2019) has remained muted for years. Nevertheless, the market has recorded some value growth as a result of ongoing premiumisation and consumers paying more attention to quality than quantity.

According to Euromonitor, AB-InBev is still not among the top 10 players in the Southeast Asian region in 2018. Therefore, it needs to make a breakthrough in countries such as Vietnam and Philippines.

That may not be all that easy in the Philippines, where San Miguel Brewery is jointly owned by the San Miguel Corporation (51 percent) and Japan’s Kirin (48 percent). It is unimaginable that Kirin will agree to a sale since it considers beer in Asia its core.

That leaves ThaiBev. Watch this space.

Read more on this topic: Ina's report on ThaiBev rumoured to mull beer IPO in Singapore next year and her appraisal why ThaiBev may spin off its beer business.